In its most basic sense, swing trading is a trading strategy in which a trader aims to gain in small amounts in short-term trends and avoid big losses by cutting them quickly. These small gains are amassing over time, which, when summed, can amount to big returns. To be able to gain in short term trends, the trader holds a (long or short) position in trading for a couple of days or weeks but usually does not exceed several weeks or months.

During swing trading, a trader aims to gain 5 to 10% of profit for most of the stocks rather than the usual target gains by traders, which is normally at 20 to 25%. Swing traders flourish not through one-time big-time profits, but through accumulated small gains from trading over time. When using this strategy, a trader holds to a position within 5 to 10 trading sessions.

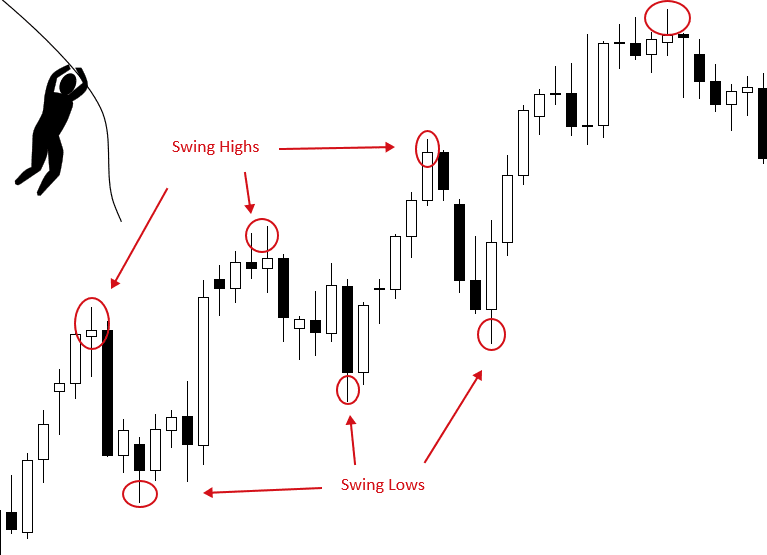

Hence, the essence of swing trading is taken from the idea of identifying ‘swings’ within a moderate-term trend and enter the trading market only when the trader senses a great chance of winning the trade.

What it takes to Swing Trade

Trading can be compared to your running or jogging preference. Are you the kind of runner who takes the shorter distance, say 100 to 500 meters? If not, you may be the runner who joins a long marathon taking 20 kilometers in a run? If you still haven’t made up your mind, you are most likely the runner in between the two runner types who takes the average 5 to 10-kilometer run. If this is you, swing trading might just be for you.

Short-distance runners are like the day traders in the markets who flourish in short-term trading and hold their positions within the trading day. Meanwhile, the marathon runners are the trend traders who capitalize on the long-term trades, holding positions for a long period of time. Lastly, average runners are the swing traders who like moderate-trend trading and holding positions in days up to a couple of weeks.

Swing trading is the strategic way of determining the future movement of the price of an asset, taking a position, and gaining small profits from the identified price movement. In this case, swing traders set minimal profit from the expected price move and completely moving on to the next trading opportunity. This being said, patience is the core virtue that a trader should exercise when doing swing trading.

Moreover, swing trading is a good trading strategy for traders who do not have the luxury of time to check and monitor their trading accounts throughout the day but exerts effort in studying the market during the night. Traders who have full-time jobs are fit for this kind of set-up.

Consider the following factors below that will help you decide if swing trading is for you.

Swing trading requires:

- A trader who can patiently hold his trades for days or even weeks;

- A trader who does not impulsively trade without analyzing the market situation and sensing a good probability of winning before entering the trade; and

- A trader who is not easily frustrated facing large stop losses.

If you possess the said qualities of a trader above, you might want to try swing trading. If you think otherwise, swing trading may not be your comfort zone and may take you to situations you wouldn’t want ending up with.

Swing Trading Basics

If you have decided to try swing trading after taking in certain considerations, you might as well learn some of the basic things that you need to arm yourself with to start a successful swing trading career.

The first thing you need to be mindful of is choosing the right stocks to trade. For swing trading, large-cap stocks are the best kind of stocks to pick since they swing between high and low trends of the market. The trader rides the wave in one direction for days or weeks and shifts to the opposite side when the stock movement changes its direction.

Another crucial factor to look into is the technical aspect of analyzing the market. In swing trading, the trader’s primary weapon is the array of technical indicator tools. Primarily, swing traders use the basic line charts identifying support and resistance levels to decide their trading position (long or short) in entering the trade.

(Traders take a long position near the support point and a short position near the resistance point.)

5 Day Trading Strategies for Beginners

SWING TRADING STRATEGIES FOR FOREX

Wie man Aktien für den Swing-Handel auswählt